Tri-State’s Colowyo coal mine in northwest Colorado has $95 million in clean-up costs. These costs are completely unaccounted for in the company’s financial filings with the federal government.

Tri-State Generation and Transmission Association seems to be going to great lengths to pass the costs of coal to its rural electric co-op members, but now it seems the company is also trying to put the American public on the hook for covering its massive coal mine clean up costs.

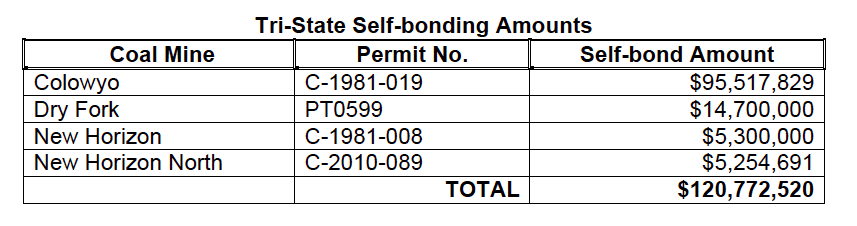

In an appeal filed with the U.S. Office of Surface Mining, WildEarth Guardians has taken aim at Tri-State’s failure to guarantee more than $120 million in coal mine reclamation obligations at four mines that the company either owns or has a stake in.

These mines include Colowyo in northwest Colorado, Dry Fork in the Powder River Basin of northeast Wyoming, and the New Horizon and New Horizon North mines in southwest Colorado.

At issue is that while the company claims to have posted what are called “self-bonds” to cover its reclamation obligations at these mines, there appears to be no accounting for these financial commitments in Tri-State’s financial filings with the U.S. Securities and Exchange Commission.

Self-bonds are already a bit of sham. They’re essentially corporate IOUs promising that if a company goes bankrupt, they’ll still have the money to clean up their mines.

By not even accounting for its self-bonds and assuring any financial commitment behind them, however, Tri-State has turned its self-bonding into a sham within a sham.

This means that should the company go under and have to walk away form its mining operations, American taxpayers would have to foot the bill for cleaning up its mines.

That’s not okay. What’s more, it’s illegal under federal law. In fact, companies aren’t even allowed to mine coal if they can’t post legitimate clean up bond to cover the full costs of complete reclamation.

In early April, WildEarth Guardians called on the Office of Surface Mining to do something about Tri-State’s sham self-bonds.

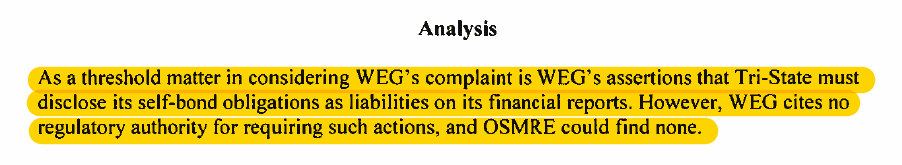

Unfortunately, in mid-May, the agency denied Guardians’ request, claiming there is no obligation for company’s to report self-bonds as liabilities.

So, we’ve appealed and are hoping the agency rethinks its position.

Resolving this issue is critical. Although Tri-State, which serves rural electric co-op members in Colorado, Nebraska, New Mexico, and Wyoming, asserts the company is financially viable and would never be in a position to have walk away from its mining operations, there are signs that the company is facing significant financial headwinds because of its coal investments.

Right now, the company is forcing its members to pay more for coal when it could be transitioning fully to renewable energy and actually lowering its rates.

As Tri-States faces member and customer defection because of its unwillingness to ditch coal and lower rates, the company faces the same “death spiral” to bankruptcy that other electric cooperatives have faced in the past, including Tri-State’s predecessor, Colorado-Ute Electric Association.

The fact that Tri-State isn’t even accounting for its coal mine reclamation obligations just underscores the company’s sketchy finances and raises even more red flags around its future viability.

And as Tri-State takes on even more coal liabilities, including an expansion of its Colowyo coal mine, the acquisition of debt related to failed coal-fired power polant in southeast Colorado, and more “clean coal” boondoggles, there’s no doubt the company is sailing in riskier and riskier waters.

And to put the company’s $120 million in coal mine reclamation obligations into context, this amounts to more than 10% of the company’s total equity, which is a bit more than $1 billion. Not accounting for liabilities that could impact 10% of a company’s equity (i.e., net worth) is a big deal and it highlights how Tri-State needs to be held accountable now.

In the meantime, we’re working with Tri-State’s rural electric co-op members throughout Colorado, Nebraska, New Mexico, and Wyoming to press the company to ditch its coal investments and transition to 100% renewable energy.